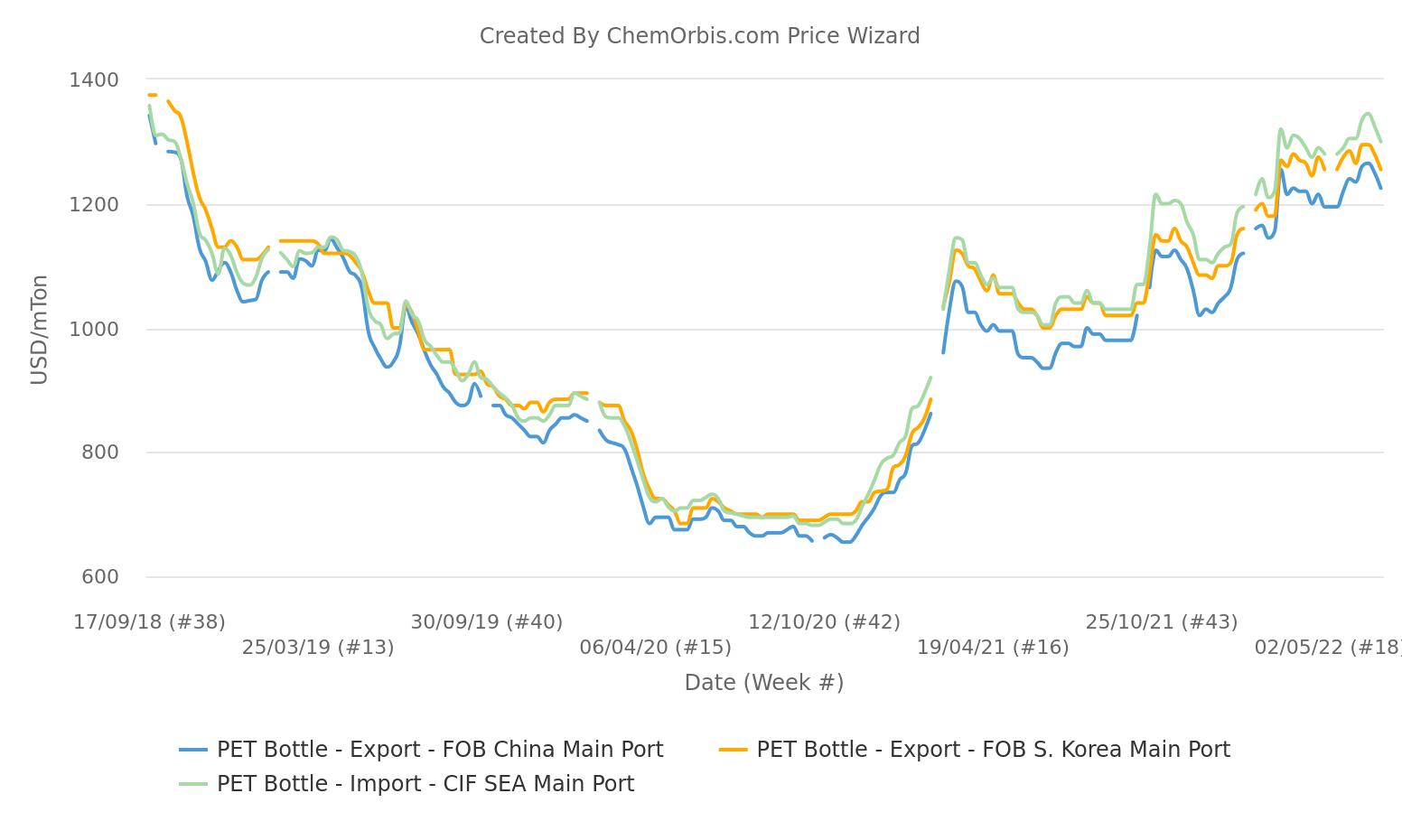

PET bottle prices in Asia hit three-and-a-half year highs two weeks ago on the back of cost support and improving export demand. However, prices have started to soften since last week given the falls in upstream markets and weakened spot buying amid fresh Covid fears in China.

As a knee-jerk reaction to the crude oil slump in the last two weeks, MEG, PTA, PX prices in Asia have witnessed visible drops. Compared to two weeks ago, spot prices on CFR China basis are down 13% for paraxylene, 8% for PTA and 4% for MEG.

PET suppliers cut offers for 2nd week

Several PET bottle producers in Asia have reduced their offers by around $10-30/ton to local and export markets for the second week in a row, pointing to lower upstream costs.

“We have cut our offers again due to falling PTA, PX, and MEG prices. Demand from Southeast Asia, Europe, and the US has improved slightly thanks to the summer season but the number of deals is still limited. Buyers are cautious amid the ongoing Russia-Ukraine war as well as the resurgence of Covid fears in China,” a source from a South Korean producer said.

A converter in Malaysia added, “We are in no rush for fresh purchases as prices currently follow a downward trend. The recent flare-up in Covid-19 infections in Beijing and Shanghai has dampened sentiment across Asia.”

All eyes are on the latest oil rebound

Although the regional PET markets continue to be dominated by lower costs and demand concerns this week, players have turned their attention to the latest rebound of oil futures. Brent crude oil futures settled $3.07/barrel higher on Friday and $1.97/barrel higher on Monday.

“The PET market might soon stabilize if the recent gains in crude oil futures push MEG, PTA, and PX prices up. Demand from the US and European markets will also be supportive amid warmer temperatures,” commented a seller in China.

(Source: chemorbis)